I found a method to consistently get 1,000% (or more) ROI.

It’s actually insane and I couldn’t believe it when I found it.

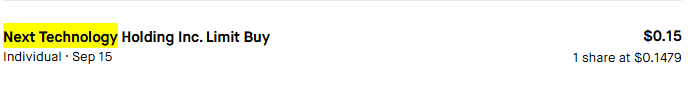

I bought this stock for 15 cents

And two weeks later I sold it for almost $28

And this all thanks to the way that exchanges/companies handle stock splits and reverse splits.

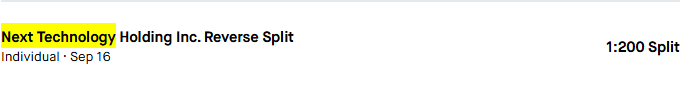

A reverse split

Next technology holding actually had a reverse split. Their board was afraid that the share price would fall to low to keep listed on the stock market exchanges. This is actually quite common.

To boost the price, they do a reverse split where they take 200 shares and turn it into 1 share at 200x the price. Theoretically, you end up with the same amount of money.

But what happens if you only own 1 share instead of 200?

They still give you a whole share (thanks to the wonderful art of rounding).

And if they don’t? You sell your share to break even.

That means you can get HUGE upside with essentially no downside.

It sounds too good to be true… So what’s the catch?

It doesn’t scale.

Buying one share is all you can do.

But if you’re wanting to start your investment journey, you have no spare income, and you can’t find the money to invest…

Then you can start this method with as little as 15 cents and easily find an extra $50-$100 each month, while you roll the profits into a standard index fund.

Sure. It’s unconventional. But sometimes we have to do things that are odd in order to hit our goals.

And the saying is true… If something sounds too good to be true, it probably is.

— Jake

P.S. you can actually do this across multiple brokerage accounts. If you have WeBull, Robinhood, etc. you can do it once in each account. So technically, it can scale a bit.